Prescription Coverage: How to Understand and Get the Most from Your Drug Benefits

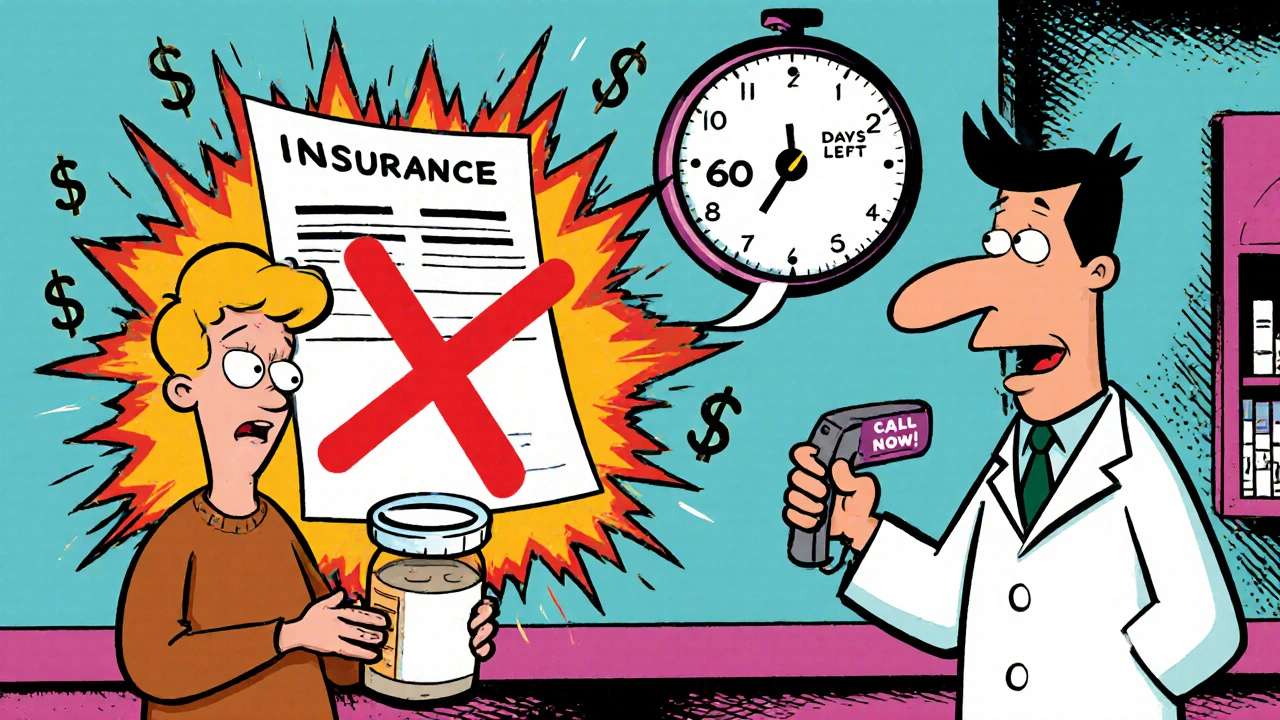

When you hear prescription coverage, the system that determines how much your insurance pays for medications, it’s easy to think it’s just about your plan’s formulary. But real prescription coverage is about what happens when the pharmacy counter says your copay is $120—and you’ve got $15 in your wallet. It’s the gap between what your plan says it covers and what you actually end up paying. And for millions, that gap is wide enough to lose your health in.

Medicare Part D, the federal program that helps seniors and disabled people pay for prescription drugs is the biggest player in this game, but it’s not the only one. Private insurers, Medicaid, and even employer plans all have their own rules, networks, and hidden cliffs. One person pays $5 for metformin. Another pays $80 for the same pill—because their plan doesn’t cover it until they hit a deductible, or their pharmacy isn’t in-network, or they’re in the coverage gap known as the donut hole. And that’s not a mistake. It’s how the system works.

That’s why copay assistance, programs that help reduce out-of-pocket costs for brand-name and sometimes generic drugs matters. Nonprofits, drugmakers, and even pharmacies offer cards and discounts that can slash your bill by 50% or more. But you won’t find them on your insurer’s website. You have to dig. And you need to know when to ask for help—like if you’re on a statin and your copay jumped after a new year, or if you’re taking insulin and your paycheck doesn’t stretch far enough. drug affordability, the ability to pay for needed medications without sacrificing food, rent, or other essentials isn’t a luxury. It’s survival.

And here’s the truth: skipping doses because you can’t afford your meds doesn’t just hurt your health—it makes everything more expensive later. A missed dose of blood pressure medicine can lead to a hospital visit that costs ten times what the pill did. That’s why medication adherence, taking your drugs exactly as prescribed, even when you feel fine is tied directly to how well your coverage works. It’s not just about willpower. It’s about design. Some plans make it easy. Most don’t.

Below, you’ll find real guides that cut through the noise. Learn how to find free or low-cost help for generics. See how government policies keep prices down without price caps. Find out why people skip pills even when they have insurance—and what you can do about it. No fluff. No jargon. Just what works for people who need their meds to last.