Insurance Formulary: What It Is and How It Controls Your Prescription Costs

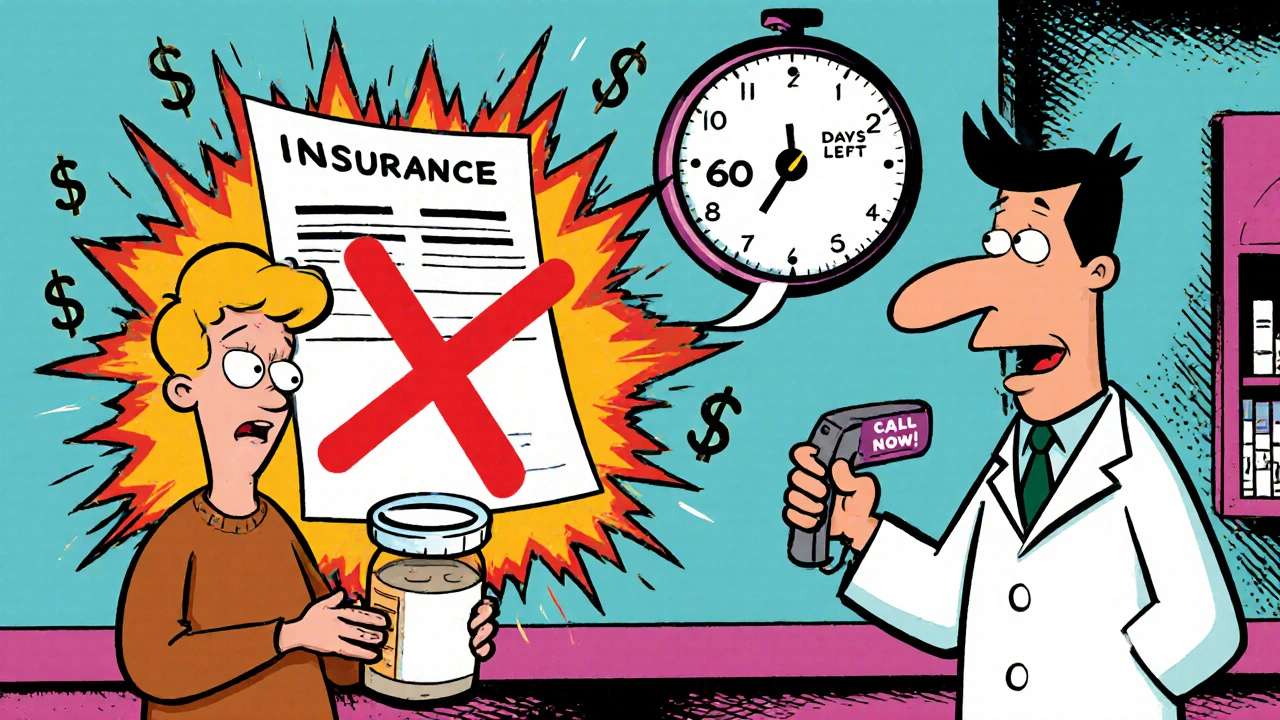

When you pick up a prescription, what you pay isn’t just about the drug’s price—it’s shaped by your insurance formulary, a list of medications your health plan covers, organized by cost and clinical preference. Also known as a drug list, it’s the hidden rulebook that decides whether your medicine is covered, restricted, or completely off-limits. If your doctor prescribes a drug not on the formulary, you might pay full price—or worse, get denied coverage unless your provider jumps through hoops. This isn’t just bureaucracy; it’s a system designed to control costs by steering patients toward cheaper, often generic, alternatives.

Most formularies break drugs into tiers, levels that determine your copay or coinsurance. Tier 1 usually includes low-cost generics like metformin or lisinopril, with copays as low as $5. Tier 2 is for brand-name drugs with generic equivalents. Tier 3 and 4 are for higher-cost specialty drugs—think biologics for rheumatoid arthritis or newer diabetes meds—where you might pay $100 or more per prescription. And then there’s Tier 5, reserved for the most expensive treatments, often requiring prior authorization, a process where your doctor must prove the drug is medically necessary before the insurer agrees to pay. This isn’t random. Insurers use formularies to push patients toward drugs that are proven, cost-effective, and often negotiated for deep discounts with manufacturers.

But here’s the catch: formularies change all the time. A drug you’ve been taking for years might suddenly get moved to a higher tier, or get dropped entirely. That’s why checking your plan’s formulary before starting a new medication matters. Medicare Part D plans, private insurers, and even employer-based coverage all have their own versions. Some cover certain generics but not others—even if they’re chemically identical. And while you can appeal a denial, the process takes time. Meanwhile, you might be skipping doses because you can’t afford the cash price. That’s why knowing your formulary helps you ask better questions: Is there a generic alternative? Can I switch to a drug on Tier 1? Does my plan offer a mail-order discount for 90-day supplies?

The posts below dive into real-world cases where formulary rules directly impact what people can afford. You’ll find guides on how to get help with generic drug costs, how Medicare Part D coverage gaps work, and how drug interactions can trigger coverage denials. There’s also advice on when to push back on your insurer, how to use copay assistance programs, and how government policies keep generic prices low without price caps. These aren’t theoretical discussions—they’re practical tools for people who’ve been hit with surprise bills or denied refills. Whether you’re managing diabetes, high blood pressure, or a chronic condition, understanding your insurance formulary isn’t optional. It’s how you take control of your care—and your wallet.