When you take a pill for high blood pressure or an antibiotic, there’s a good chance it was made in China or India. These two countries supply the world with most of its generic drugs and active pharmaceutical ingredients (APIs). But behind the low prices and high volumes lies a complex reality: China and India manufacturing carry very different risks-and the FDA watches them in very different ways.

Why the FDA Cares So Much

The FDA doesn’t just inspect factories for fun. Every batch of medicine that enters the U.S. must meet strict standards. A single contaminated batch can cause illness, death, or massive recalls. That’s why the FDA sends inspectors to factories overseas-sometimes unannounced. Between 2020 and 2023, U.S. inspectors found nearly twice as many serious violations at Chinese facilities compared to Indian ones. For every 100 inspections, Indian plants received about 30 Form 483 notices (official warnings), while Chinese plants got over 40. That gap hasn’t closed. In fact, in 2023, 37% of Chinese pharmaceutical facilities were under import alerts, meaning the FDA could block shipments without further review. For India, that number was 18%.India’s Edge: Compliance Over Scale

India has 100+ FDA-approved drug manufacturing plants. China has 28. That’s not a typo. India leads the world in the number of facilities cleared to supply Western markets. Why? Because Indian companies learned early that compliance isn’t optional-it’s the price of entry. Indian manufacturers built their business model around generic drugs for the U.S. and Europe. That meant following FDA rules from day one. Many plants now use digital systems to track every step of production-temperature, humidity, raw material batches, even who touched the equipment. Bain & Company calls this "digital interventions across plants to eliminate errors and ensure consistent quality." It’s not fancy tech. It’s basic, reliable process control. The result? Global pharma companies trust India more. In a 2022 survey, 12% of U.S. drugmakers said India was their top outsourcing choice. Only 9% picked China. That’s not because India is cheaper-it’s because it’s predictable. When a company needs to pass an FDA audit, they want to know their supplier won’t surprise them with a violation. India delivers that reliability.China’s Strength: Volume and Cost

China makes about 80% of the world’s active pharmaceutical ingredients. That’s the raw chemical backbone of nearly every pill you take. No other country comes close. China’s factories are massive, integrated, and optimized for output. Labor costs are still lower than in India, and the government has poured billions into building chemical supply chains that stretch from raw materials to finished tablets-all under one roof. But scale doesn’t equal safety. Many Chinese plants still rely on manual record-keeping. Quality checks are inconsistent. Some smaller suppliers cut corners to meet price targets. That’s why the FDA keeps a closer eye on China. In 2023, the agency increased inspections of Chinese facilities by 22% compared to the year before. It’s not because China is worse than it used to be-it’s because the stakes are higher. The U.S. depends on China for critical medicines, and that dependency creates risk.

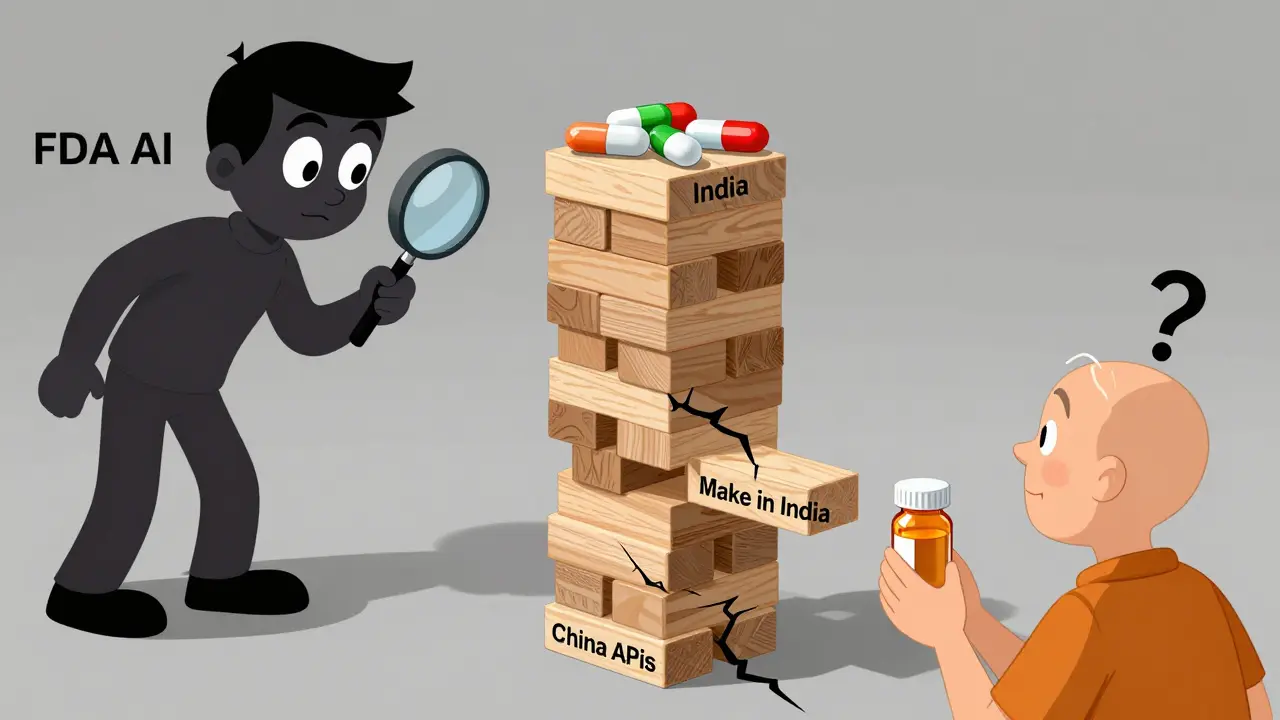

The Hidden Weakness: India’s API Dependence

Here’s the twist: India, the compliance champion, gets 72% of its APIs from China. That’s up from 66% just two years ago. So while India makes the final pills, the core ingredient often comes from China. That creates a dangerous blind spot. Imagine this: You’re a U.S. drugmaker using an Indian-made antibiotic. Your supplier says their product is FDA-compliant. But the API inside? Made in a Chinese plant that just got flagged by the FDA. That’s not a hypothetical. It’s happened. And when that happens, the entire batch gets blocked-even if the Indian company did everything right. This is why experts call it a "single point of failure." India’s strength in final manufacturing is undermined by its reliance on China’s weaker upstream supply chain. The Indian government is trying to fix this with a $3 billion incentive program called "Make in India," aimed at boosting domestic API production. But building a chemical plant takes years. And right now, China still owns the pipeline.The "China+1" Strategy

After the pandemic, companies stopped putting all their eggs in one basket. The "China+1" strategy means diversifying supply chains-adding another country as a backup. For pharma, that country is almost always India. Why? Because India’s regulatory culture is aligned with Western expectations. English is widely spoken. FDA inspectors find Indian staff more responsive. Audits take less time. Companies report less "audit fatigue"-the exhaustion of constantly proving compliance. But "China+1" isn’t about replacing China. It’s about reducing risk. If a Chinese plant shuts down due to an inspection, or if trade tensions spike, companies with Indian backup can keep producing. That’s why major firms like Pfizer, Novartis, and Teva have expanded Indian operations. They’re not abandoning China-they’re hedging.

What’s Changing in 2026?

India’s regulatory landscape is tightening. In 2023, the country updated its Schedule M rules-the local version of GMP (Good Manufacturing Practices). The new rules require real-time data logging, stricter environmental controls, and more frequent internal audits. It’s expensive. Smaller Indian manufacturers are struggling to keep up. But the ones that do? They’re becoming the preferred partners for global brands. China, meanwhile, is trying to move up the value chain. Instead of just making cheap APIs, it’s investing in biologics, biosimilars, and gene therapies. Its biopharmaceutical market is growing at nearly 20% per year-faster than India’s. But that’s a long-term play. For now, most of China’s output is still low-cost generics. The FDA is adapting too. It’s using AI to analyze inspection data and predict which facilities are most likely to fail. It’s also sharing more information with regulators in India and China to spot trends early. But human inspectors still walk the floors. And they’re watching closely.Who Wins? Who Loses?

India wins when the world needs reliable, compliant medicines. It’s the go-to for branded generics, complex formulations, and products where quality can’t be compromised. But it loses when it can’t make its own APIs. That’s a vulnerability. China wins when price and volume matter most-like for bulk antibiotics or vitamins sold in low-income countries. But it loses when regulators demand transparency, traceability, and consistency. That’s the future of global pharma. The real winner? The patient. When supply chains are diverse, medicines stay available. When quality is enforced, medicines stay safe. The tension between China and India isn’t just about economics-it’s about health.What Should You Know as a Consumer?

You probably won’t know where your medicine was made. Labels don’t say. But you can ask your pharmacist. If you’re on a critical medication-like insulin, blood thinners, or heart drugs-know that the FDA is actively monitoring the factories behind it. And if you hear about a recall, it’s likely tied to a manufacturing issue in one of these two countries. Don’t assume "made in India" means safer. Don’t assume "made in China" means risky. The difference isn’t in the country-it’s in the factory. And the FDA is working hard to find the good ones.Why does the FDA inspect factories in China and India?

The FDA inspects overseas factories because a large portion of the medicines used in the U.S. are made abroad. The agency must verify that these facilities follow the same safety and quality standards as U.S. plants. This includes checking for contamination, accurate labeling, proper storage, and consistent manufacturing processes. Without inspections, there’s no way to guarantee that a pill bought at a pharmacy meets U.S. safety rules.

Is medicine from India safer than medicine from China?

On average, yes-based on FDA inspection data. Indian facilities have consistently received fewer serious violations and import alerts than Chinese ones. This is because Indian manufacturers have focused on meeting Western regulatory standards for decades, especially for generic drugs sold in the U.S. and Europe. However, safety depends on the specific factory, not the country. Some Chinese plants meet or exceed standards, and some Indian suppliers still have issues. The key is compliance history, not geography.

Why does India rely on China for active ingredients?

India has built a strong business around turning APIs into finished pills, but it never fully developed its own large-scale chemical production for raw ingredients. China invested heavily in chemical manufacturing decades ago and now produces most APIs at lower cost and higher volume. India’s domestic API industry is still catching up. This dependency creates risk-if China restricts exports or a plant fails inspection, India’s medicine supply can be disrupted.

What is the "China+1" strategy in pharma?

The "China+1" strategy means companies don’t rely solely on China for manufacturing. They add a second country-usually India-as a backup. This reduces risk from political tensions, supply chain disruptions, or regulatory crackdowns. For pharmaceuticals, India is the top choice because of its strong compliance record, English-speaking workforce, and existing FDA-approved facilities. It’s not about replacing China, but making supply chains more resilient.

Are generic drugs from India and China as effective as brand-name drugs?

Yes-if they’re made by approved manufacturers. Generic drugs must contain the same active ingredient, strength, and dosage form as the brand-name version. The FDA requires them to be bioequivalent, meaning they work the same way in the body. The difference is in the inactive ingredients and packaging, not effectiveness. The real risk comes from unapproved or poorly made generics, which is why FDA monitoring is so important.

How can I know where my medicine is made?

Most drug labels don’t list the manufacturing location. You can sometimes find it on the package insert or by asking your pharmacist. Some online pharmacies list the manufacturer’s country, but not always accurately. The best way to ensure quality is to buy from reputable sources and check if your medication is on the FDA’s approved list. If you’re concerned, ask your doctor about generic alternatives from trusted suppliers.

owori patrick

January 31, 2026Really appreciate this breakdown. I work in global health supply chains and seeing the numbers side-by-side like this helps clarify why we’ve shifted so much of our sourcing to India over the last few years. It’s not about patriotism-it’s about not having to stay up at 3 a.m. worrying if a shipment’s gonna get flagged.

Claire Wiltshire

January 31, 2026This is one of the most balanced takes I’ve read on this topic. The point about India’s API dependency being a blind spot is critical-and often overlooked. It’s like building a fortress with a door made of paper. The FDA’s AI-driven risk modeling is a step in the right direction, but we need more transparency from both countries’ regulatory bodies. Maybe a public dashboard of inspection outcomes?

Darren Gormley

February 2, 2026😂 India’s ‘compliant’? Bro, they still have factories where the QA guy uses a stopwatch and a clipboard. The FDA’s numbers are skewed because they inspect Indian plants more often-because they’re *expected* to be clean. China’s just lazy. Also, 80% of APIs? That’s not a strength, it’s a hostage situation. 🇨🇳👑

Mike Rose

February 3, 2026so like… china makes the stuff, india makes the pills, and we just hope it works? lmao. why dont we just make it here? 🤷♂️

Sheila Garfield

February 4, 2026I’ve been on both sides of this-worked with a Chinese API supplier and an Indian formulation house. The truth? It’s not about the country, it’s about the plant. I’ve seen pristine Chinese labs and Indian ones where the air smelled like burnt plastic. The FDA’s data is useful, but it’s still a snapshot. We need continuous monitoring, not just annual audits.

Shawn Peck

February 5, 2026Let me get this straight-China makes 80% of the world’s medicine ingredients and we’re just gonna ‘diversify’? That’s like saying ‘we’ll get coffee from Colombia instead of Brazil’ while still drinking 90% Brazilian beans. This isn’t risk management, it’s wishful thinking. The U.S. is addicted to cheap pills and now we’re surprised when the dealer ghosts us.

Niamh Trihy

February 7, 2026One thing missing here is the human cost. In India, the push for compliance has led to layoffs in smaller plants because they can’t afford the digital systems. In China, workers in API plants often have no protective gear. The FDA checks the machines-but who checks the people? Safe medicine shouldn’t come at the cost of safe labor.

Jason Xin

February 8, 2026Interesting. I’m surprised no one’s mentioned the elephant in the room: the U.S. government subsidizes drug prices, which forces manufacturers to cut costs. If we paid more for generics, companies could invest in better infrastructure-either in India or at home. But we want $4 insulin and blame China when it breaks. We’re the problem.

KATHRYN JOHNSON

February 8, 2026India is not a safe alternative. Their regulatory body is corrupt. The FDA’s inspections are the only thing keeping them honest. China is the real threat, but India is a fraud with a nice website. We need to stop pretending this is a moral issue-it’s a national security crisis.

kate jones

February 10, 2026From a supply chain risk perspective, the ‘China+1’ model is textbook. But the deeper issue is systemic: we’ve outsourced critical infrastructure to two countries with divergent governance models. The FDA’s AI tools are helpful, but we need a global pharmaceutical governance framework-like the IAEA for nuclear materials. Otherwise, we’re just playing whack-a-mole with contamination events.

Kelly Weinhold

February 11, 2026Guys, I know this sounds scary, but let’s stay positive! 🌱 India’s making huge strides with their Make in India initiative, and China’s investing in biologics-that’s actually kind of exciting! We’re not just talking about pills, we’re talking about the future of medicine. Maybe one day we’ll have AI-made drugs grown in labs right here in the U.S., and then we won’t have to worry about any of this. Until then, let’s support the good factories and keep pushing for change. We’ve got this! 💪❤️